A good savings account allows you to effortlessly save for ANY financial goal:

- Weddings

- Engagement rings

- Trips to Paris

- Down payment on house

- New car

- Front row tickets to a Jay-Z and Beyonce concert

Whatever!

And when you combine it with automation, you create a powerful financial tool that allows you to save passively too.

BUT all accounts aren’t created equal: beware of the Big Banks. Extortionate fees and terrible customer service make them a bad deal for most people. Instead you should get an online savings account.

If you’ve ever had a Big Bank, you know what I’m talking about: Minimum fees, overdraft penalties, crappy interest rates, and (my least favorite) mailing you dumb promotional material every. Single. DAY.

There are plenty of great online accounts to choose from too — but after evaluating many options I’ve boiled it down to one: Capital One 360.

The BEST savings account: Capital One 360

Source: Consumerist

This is the account I recommended in my book and it’s still the account I use today, years later.

Why? A few things:

- No fees, no minimums

- 1% APY

- You can do everything online in an ultra-simple interface

- No annoying upsells sent via postal mail = no paper cuts

- Links to your checking account via electronic transfer

- BEST PART: Sub-savings accounts (more on this later)

The account also comes with a lot of great online savings tools to help you keep track of your financial goals.

Overall, this makes Capital One 360 Savings the best deal for anyone who wants to take their personal finance goals to the next level.

How to open a Capital One 360 Savings account

Click here to get started with the Capital One 360 Savings. NOTE: It’s not an affiliate link. I’m not a rep for Capital One — just a happy customer.

Get ready to fill out a few forms with your personal information (name, address, DOB, etc.) as well as more private information (social security number). The process won’t take more than 30 minutes and when you’re done, you’ll be ready to get started saving.

BUT I have another savings account suggestion. It’s important to have multiple options.

Runner-up: Ally Bank Online Savings

Source: GoBankingRates

Ally is an online bank — and they’re a great choice for anyone looking for a solid savings account.

A few things to note:

- 1.45% APY

- No fees, no minimums

- Can create multiple accounts

- Easy online interface

- Interest compounded daily

Though Ally savings accounts don’t technically have sub-savings accounts, it does allow you to create multiple savings accounts that effectively do the same thing.

The “sub-savings” accounts of a brave IWT worker.

Click here to get started with an Ally savings account. It’ll be the same process as with the Capital One 360 savings account.

Once you do you’ll be able to open up multiple savings account on the same day. And having accounts where you can segment your savings goals is crucial to achieving them. That’s why I want to go into what exactly sub-savings accounts are and why they’re so important.

The importance of sub-savings accounts

I mentioned how psychologically important it is to have sub-savings accounts, rather than one lump “savings” area.

Check out this screenshot of my old sub-savings accounts:

You see why this matters?

If your friends call you up and say “Hey dude, let’s roll to Vegas this weekend,” you’re not going to be like, “Hang on guys … let me initiate a transfer from my ‘down payment’ sub-savings account, which should take 24-48 hours.”

You could … but you won’t.

This is a GOOD THING.

Using my automated personal finance system, I use monthly automatic transfers to funnel money into each of my sub-accounts. Now that these transfers are in place, I’m getting closer to each of my goals automatically, month after month, without having to remember to set money aside.

This is precisely how people get rich “passively.” You don’t see the money when it’s automatically withdrawn from your checking account and shunted to specific savings goals — you will never miss it. However, a few months later, you’ll be amazed at how fast you’re accomplishing your goals.

By the way, it’s possible to simulate sub-savings accounts with any savings account (for example, by manually creating your own “sub accounts” in Excel).

But I like Capital One 360 and Ally because they just do it for me. Why give yourself another financial chore to think about? Don’t take more than five minutes deciding. Just pick one and move on.

I cover the use of sub-savings accounts in more detail in my blog post “Sub-savings accounts: How to save for anything in 3 steps.” It’s an incredibly powerful way to make your savings more streamlined and purposeful.

Don’t chase rates — look for these 3 things instead

The two accounts I suggest above are great — BUT they’re just my recommendations. Do your research and look into what works for you.

Let me offer you another word of advice though: Don’t be a rate chaser.

A lot of people ask about the 4-5% interest rate that ING and other high-interest banks used to pay, which I quoted in my book. Unfortunately, those interest rates are variable, meaning they change with the economy. As a result, many online banks don’t offer the same rates they used to.

However, do NOT waste your time chasing rates. A 1% difference on a balance of $10,000 is $8.33/month. That’s a small win and hardly worth your time.

If you write me and say, “But Ramit, XYZ bank has 0.2364% higher interest rate. LOL! U R WRONG!” I am going to (1) mock you, (2) make you my “troll of the week” on Instagram so my followers can mock you too.

Instead, you should be looking at three things when searching for a good bank:

- Trust. This is one big thing Big Banks (e.g., Bank of America, Wells Fargo, Chase) lack. I know because I had a Wells Fargo account (aka Wells “Let’s open millions of fake accounts” Fargo) for YEARS because their ATMs were in my area — but I’ve since learned better. You can’t trust banks that do skeezy things like double charging you for using other ATMs or nickel-and-diming you through minimums and fees. Their offers should be clear and easy to set up.

- Convenience. Your bank needs to be convenient — otherwise you’re not going to be able to take full advantage of it. You need to be able to get money in and out and also transfer it easily. You can make sure that a bank is convenient by browsing around its website and making sure that they have a reliable customer support team.

- Features. The best high interest savings account is going to be the one with other great features like prepaid envelopes for depositing money, sub-savings accounts, and online savings goals tools.

Find a bank with those three things and you’re set for life. Once you do, it’s time for you to automate your finances to optimize your savings potential.

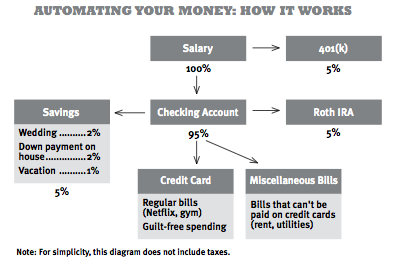

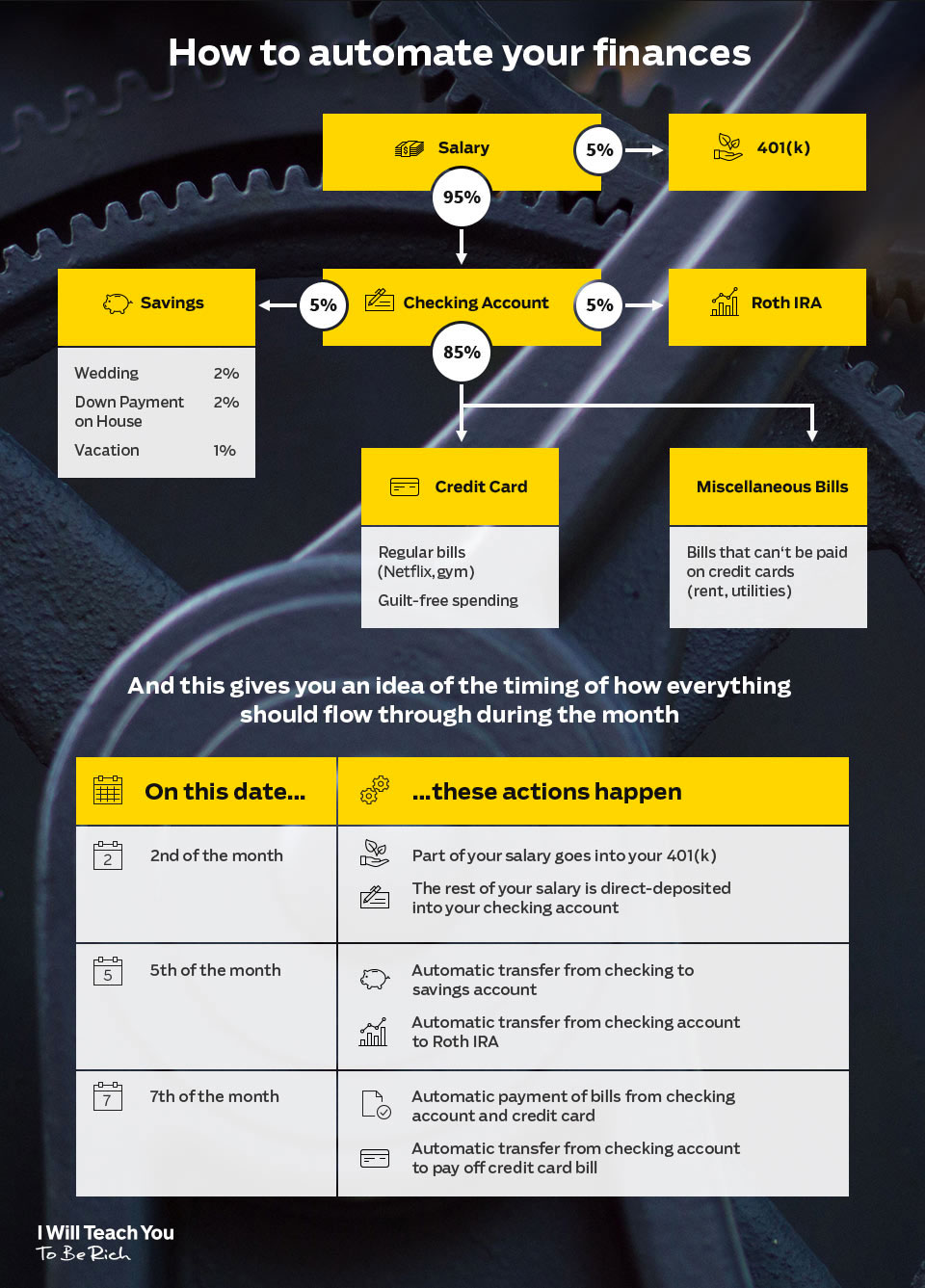

Automate your finances and save for ANYTHING

I. Talk. About. This. A. LOT. But that’s only because it’s the best way to invest, save, and earn money. This system allows you to automatically send your money where it needs to go as soon as you receive your paycheck.

And it’s simple: Each month, your paycheck is automatically divvied up and sent exactly where it needs to go (pay bills, pay rent, invest, save, etc.) without you needing to touch it. This allows you to save for any goals passively, making it easier to save than ever.

To find out more on how to automate your finances, check out my 12-minute video explaining it here:

If you want to cut down the time it takes to save for your goals even more, I have something for you:

In it, I’ve included my best strategies to:

- Create multiple income streams so you always have a consistent source of revenue.

- Start your own business and escape the 9-to-5 for good.

- Increase your income by thousands of dollars a year through side hustles like freelancing.

Download a FREE copy of the Ultimate Guide today by entering your name and email below — and get on your way to accomplishing your savings goals.

The best savings account to open today is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment