So you just heard the term “debt to asset ratio” thrown around by that pedantic guy at a cocktail party and now you’re surreptitiously looking up the term on your phone so you don’t look dumb.

(And maybe you also want to be able to use the term yourself.)

Here’s what debt to asset ratio means:

When you’re a business (i.e. you have your own hustle or side hustle), your debt to asset ratio represents the total amount of debt you owe compared to your total amount of assets.

This determines how much lenders will be willing to give you AND helps you be aware of how much you owe to creditors.

If you’re an individual, the debt to asset ratio won’t be as relevant to you…but your debt to INCOME ratio will be. That’s the number representing the total amount of debt you owe compared to your income.

Mortgage lenders, bank loans, and anyone giving you credit will take a look at your debt to asset/income ratio in order to determine how much they’re willing to lend to you.

Your debt to asset ratio (or debt to income ratio) could mean the difference between securing a loan for your business or home, and not getting a single dime from a lender.

To help you get a better understanding of it, let’s break down what debt to asset ratio might look like in real life.

ELI5: Debt to asset ratio

Let’s say an unemployed acquaintance of yours, we’ll call him Jeff, asks to borrow $10 from you.

What do you do?

Immediately, with your $10 in your hand, you’ll ask yourself a bunch of questions about Jeff, including:

- “Do I trust Jeff?”

- “Will Jeff pay me back?”

- “Whoa, why is the guy from Hamilton on the $10?”

Hard to answer these questions, right? Now pretend a third person, your mutual friend Mary, tells you that Jeff borrowed $100 from her last week and hasn’t paid it back. Now what do you do?

You slip your $10 in your pocket and move on.

In a nutshell, this is debt to asset ratio.

However, that’s not the only debt ratio I want to cover today. In IWT fashion, we’re going to give you the rundown on three debt ratios that are going to matter the most to you, your life, and/or your business. They are:

It’s so important to keep these numbers in mind to be aware of your debt (if you have any that is), because when they’re out of whack they can stifle your ability to make some big purchases.

But what makes up your debt ratios exactly? And what’s the formula to each? I’m going to answer all those questions in a bit — and if you’re a weirdo like me, you might even find the math behind it all exciting.

(If you don’t, here’s a song you can play in the background to make it more exciting.)

Debt to asset ratio: Important for businesses

(NOTE: If you’re not a small business owner or don’t run your own side hustle, you can skip down to debt to income ratio.)

Like your credit score, your debt to asset ratio is a number. One that shows you how much of your assets — things like your cash, investments, inventory, etc. — were paid with debt, including:

- Credit cards

- Bank loans

- Student loans

- Mortgages

(Pretty much any instance that you owe money to someone.)

The way you calculate your debt to asset ratio is simple: Take the amount of debt you owe and divide it by the value of the assets you own. Then, take that number and multiply it by 100 so you get a percentage. That’s your debt to asset ratio.

It’ll look something like this:

Debt to asset ratio

And then:

It’s really that simple.

What is good debt to asset ratio?

The higher your debt to asset ratio is, the more you owe and the more risk you run by opening up new lines of credit.

According to Michigan State University professor Adam Kantrovich, any ratio higher than 30% (or .3) may lower the “borrowing capacity” for your business. That’s why it’s so smart for you — especially if you’re a business owner or freelancer — to know your debt to asset ratio.

However, the amount your debt to asset ratio affects your business will vary from industry to industry.

For example, businesses that offer internet services generally don’t require a lot of debt up front to start. That means they’ll typically have lower debt to asset ratios on average.

However, industries such as production or retail require a LOT of debt up front in order to get started. As a result, it’s not uncommon to see higher debt to asset ratios among them.

Check out the chart below to find out the average debt to asset ratio in a few different industries.

|

Industry |

Average debt to asset ratio |

|

Internet services and social media |

25% |

|

Consumer electronics |

34% |

|

Energy |

108% |

|

Technology |

110% |

|

Utilities |

228% |

|

Retail |

289% |

From CSI Market (a market analysis organization)

“Holy crap, Ramit! Why are businesses like utilities and retail so high?”

Businesses like utilities and retail require a whole lot of initial capital up front to cover initial costs of things they need to run their business (infrastructure, products, manpower, etc.). As such, the average debt to asset ratio for those businesses will be higher.

Many lenders such as banks and mortgage companies may take this into consideration when they’re lending to you and your business.

Say you’re a small business owner looking to get a new loan for your venture. After totaling everything up, you find that you owe about $25,000 in debt and own about $100,000 in assets.

After dividing your debt by your assets and multiplying that number by 100, you discover that your debt ratio is 25% — which is just about the average if you work in internet services and stellar if you work in retail.

However, if those numbers were flipped (you owe $100,000 in debt and own only $25,000 in assets), your debt to asset number would be 400% — which is just awful no matter what your business does.

A note on debt to equity ratio

Sometimes, lenders will look at a business’s debt to equity ratio instead. Chances are this doesn’t apply to 99.999% of you. But so you know, debt to equity looks at a company’s debt compared to shareholder equity (the value of the shares) and is calculated the same way as debt to asset ratio:

Debt to equity ratio

And then:

Like debt to asset ratio, your debt to equity ratio will vary from business to business.

However, general consensus for most industries is that it should be no higher than 2 (or 200%).

“But Ramit, I don’t have a big company or business. Does any of this matter to me?”

Yes! Because there’s a formula that creditors and lenders use to assess the risk of individuals like you.

Debt to income ratio: Important for individuals

If you plan on ever getting a mortgage for a house, you need to make sure your debt to income ratio is in check.

This number compares your gross monthly income to your monthly debt. Banks and other lenders look at this number to determine how much of a risk you are to lend to. The more of a risk you are, the less of a chance they’ll lend to you at all.

Much like your debt to asset ratio, calculating it is simple:

And then:

Let’s run an example scenario:

Say you owe about $1,000 in debt month-to-month and make $75,000 a year ($6,250/month). We’d then take 1,000 divided by 6,250 in order to get our debt to income ratio, like so:

Multiply .16 by 100 and you have 16% for your debt to income ratio….but what does that number mean?

What is good debt to income ratio?

The lower the number is, the better. According to Wells Fargo, the ideal debt to income ratio is 35% and below. That said, most lenders will provide you a loan up to 43-45%.

So if your debt to income ratio amounted to 16% like in the example above, you’d be in good shape for a home loan.

If your debt to income ratio is a little higher and you want to lower it, though, I’d like to help you out.

After all, being in debt is the #1 barrier to living a Rich Life, and not only is it a financial burden, but it can also be a HUGE psychological burden as well.

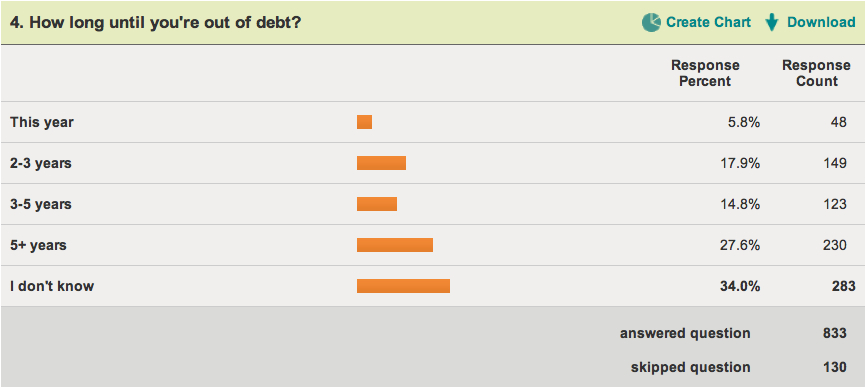

For example, a while back I ran a survey of my readers who were in debt, asking them a seemingly simple question: How long until you’re out of debt?

Take a look at the results:

34% (the majority) of respondents DIDN’T KNOW how long it would take until they were out of debt.

Debt is just as much of an emotional issue as a financial one. That’s why throwing a personal finance book at someone in debt or showing them a debt calculator produces little to no change.

If someone’s too afraid to even open the envelopes that will tell them how much they owe, “information” is not what they need. Instead, that person has to be willing to take action THEMSELVES before anything will change.

If you’re reading this now, and you’re ready to take action against your debt, I want to help you.

In fact, you can start getting out of debt TODAY through a 5-step system I’ve developed.

I highly suggest you check out the article with the system, but I’ll give you a quick rundown of it now:

- Step 1: Find out how much debt you owe. This might seem obvious but many people ignore this step due to simple psychology. We’re embarrassed/scared/confused by our debt. As such we ignore it. To be able to get out of debt though you need to get over this fear and find out exactly how much you owe and who you owe it to.

- Step 2: Decide what to pay off first. Not all debt is made equal. You need to prioritize the debt with the highest interest rate first as that’ll give you the biggest win.

- Step 3: Eliminate temptation. You can’t get out of debt by getting into more debt. That’s why you need to get rid of your credit cards until you’re finally free of the debt you already have.

- Step 4: Negotiate lower debt. Not many people realize this but you can actually negotiate your credit card interest rate down. Doing so can save you hundreds or even thousands in the long run. Check out my video below for more information.

- Step 5: Decide how you’re going to pay off your debt. Your options include leveraging hidden income, earning more money, or cutting expenses.

Though it’s just 5 steps, it can be a lot more difficult than you think. But if you’re willing to put in the time and work to be a Top Performer, I promise you you’ll be able to wipe out your debt in no time.

For more information on how to get out of debt, check out my article on the topic here.

You can also watch my three-minute video on how you can negotiate your debt below.

Get out of debt and live a Rich Life

So that’s your debt to asset ratio. It’s a good way to keep an eye on your personal finances and an element to consider if you want to get a loan.

Eliminating debt is just the first step on the journey to living a Rich Life.

Download a free copy of my Ultimate Guide to Making Money to learn my best strategies for creating multiple income streams, starting a business, and increasing your income by thousands of dollars a year.

Just enter your name and email below to get instant access to the Ultimate Guide to Making Money.

What debt to asset ratio is (and how to find yours) is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment